Www.GoMercury.com Pre-Approved Application for Mercury Credit Card

Updated: 7 Aug 2024

610

Imagine being selected to get a pre-approved credit card application by GoMercury Financial to help you manage your credit efficiently, even without access to a premium credit card. Cool, right?

This imagination could be a reality, and you could get pre-approved for competitive credit products with favorable terms even without applying first. To make it happen, you need to make it happen: just meet specific credit criteria and become a qualified applicant.

Now, you must be wondering what to do to become qualified and the best match as a pre-approved offer holder. Here is your all-need-to-know guide; you just need to continue reading…

What is WWW.Mercury.com Pre-Approved Application?

Before moving forward, let me tell you that GoMercury Financial understands the importance of efficient and responsible financial solutions for those who have a proven credit profile. For this purpose, it pre-scanned your previous credit history and other financial information and offers a pre-approved application in the form of a reservation code for a reliable credit card without even applying for it first.

How Does the Pre-Approval Process Work?

- Financial history Collection credit bureaus to identify potential customers who meet certain credit criteria.

- Screening individuals on the basis of credit score, payment history, and existing debt levels to determine who is likely to be eligible for financial products like a credit card.

- sends out pre-approved offers via mail, email, or through the website

- Getting responses to complete the application process may involve providing additional information and consenting to a hard credit check.

Remember: A pre-approved offer is not a guarantee of approval; you will still need to follow the post-approval steps to complete the application.

Post-Approval Steps

- Verify the offer by reading the terms and conditions of the offer, which will help you understand it better in terms of interest rates, fees, rewards, and, most importantly, the reputation of the offer sender.

- Figure out the decision based on your needs, go for it if you actually need to, and better avoid it when it feels unnecessary.

- Keep yourself engrossed with other available options like Capital One, Discover, American Express, Chase, Citi, and others, and go with the most suitable.

- Complete the application if you are satisfied with the sender and are getting the best deal in comparison to the other offers in the market. For this, get your personal information, such as your Social Security number, employment details, and income, in hand to complete the application on the portal.

- Monitor Your Credit by keeping an eye on your credit report to ensure there are no errors or unauthorized activities.

It’s a common concern about what qualified users should do after getting a pre-approved application for a credit card from Gomercury. Here are the recommendations you may follow:

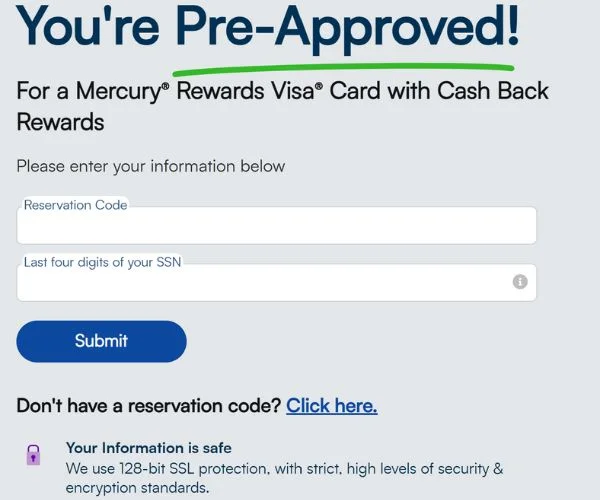

Utilization of a pre-approval code that is received with Www.Mercury Pre-Approved Application

A pre-approval cord or a www.gomercury.com reservation code is a code that you will receive with your pre-approved application on the basis of the pre-screening of your credit card. You will enter it on your application portal as an indicator of your acceptance for the initial creditworthiness assessment.

To know more about this reservation code, you can check my detailed guide that aims to streamline your online application process by equipping you with information to make the correct use of this pre-approval code to let GoMercury for a quick retrieve and verify your pre-approved status and credit information.

Please check the video below for more information:

Steps of the Online Application Process

Finally, after making up your mind to go for the completion of the application for the credit card, you will follow this step-by-step process for the completion of the online application:

- After receiving the Pre-Approval Offer via mail or email, including a unique reservation code.

- Here, you will need to enter your reservation code and the last four digits of your Social Security Number (SSN)

- Click the “Submit” button.

- Fill out the other required information, including additional personal and financial information, on the Application Portal or Mercury mobile app to finally complete the application.

Afterwards, you will wait for the approval of the credit card, and after getting approval, the final step will be activating the credit card for its use.

Checking Application Status

After submitting your application, the next equally important step is to monitor the application status regularly.

Now the question is how could you Monitor Your Application

So here are two ways:

- Online: The first one is checking the status of the application on the Gomercury online portal through the GoMercury.com website. To do this, you have to log into your application account or use the provided application reference number.

- Mobile App: The second way is more direct, which is through the GoMercury mobile app. Through this app, you can easily get traction on your application status.

Whether you are checking it through an online portal or mobile app, go and locate the updates where you will see the status of your application as still under review or approved.

Remember: Another notification could be for the requirement for additional documents, and to keep track of these alerts, you need to ensure regular email check-ins.

GoMercury Credit Card Activation

After getting an “Approved” status for your application, you still need to activate it because you can not use it without activation.

Here are the Steps to Activate the New GoMercury Credit Card:

- First, locate the instructions for activating your card, which are typically imprinted on the new card.

- Now, you have three options to choose from for the activation online, by phone, or through the mobile app. Choose which is most suitable in your case.

Methods for Activation:

- Online:

- Visit the GoMercury website and log in to your account.

- See the card activation section.

- Enter the required details, which could be your security code, card number, etc.

- Follow the instructions and add the information to complete the activation process.

- Phone:

- Call the activation number provided with your card.

- Then, do what is being instructed to you through automation following a call with a customer service representative.

- As a last step of card activation, provide them with all the details that they ask

- Mobile App:

- Open the GoMercury mobile app and log in to your account.

- Find the card activation section in the app.

- Give the required information as per the screen instructions.

Setting Up Security Measures:

- PIN Setup: During activation, you may be prompted to set up a Personal Identification Number (PIN) for added security, especially for ATM withdrawals and certain purchases.

- Online Account Access:

- Create a secure password for your online account if you haven’t already done so.

- Enable two-factor authentication if available for added security.

- Update your security questions and answers.

By following these steps, you can easily check the status of your Mercury credit card application and activate your new card securely and efficiently.

Types of Credit Cards Offered by GoMercury.com:

With a range of credit card options offered by GoMercury.com, you need to select according to your needs and preferences. The best things to look for in your expected purchase for the next credit card are a cash-back rewards card, a low-interest card for balance transfers, or a card with travel benefits and others, so here is the breakdown of the credit cards offered by Gomercurry Financial.

Here is the breakdown:

| Card type | Ideal Customers | Annual Fee | APR | Rewards Program |

|---|---|---|---|---|

| Mercury Classic | Basic needs and first-time users | $0 | 23.99% | None |

| Mercury Gold | Everyday spending | $59 | 19.99% | 1 point per dollar |

| Mercury Platinum | Higher spending limits | $99 | 16.99% | 2 points per dollar |

Note: if you need a detailed guide on these types of credit cards, along with the features and benefits of each kind and the expert’s insights to get the most out of your credit card limit, then you can read the Mercury Credit Card guide here.

Now, after card activation or during its usage, if there is a moment when you feel entangled with an error or a query or in case of a suspicious activity or any other circumstance where you feel the need to take customer support, follow these steps.

GoMercury.com Support Options

GoMercury.com offers several methods for their users to avail customer service; here are those contact methods:

- Phone service for immediate assistance.

- Email for non-urgent inquiries or issues that require detailed explanations.

- Live Chat for quick and convenient support.

Furthermore, mercury also provides Assistance with Account Maintenance, Disputes, and Card Features.

Mercury Mobile App

Now, after getting the application and card activation done, Gomercury does not leave you here. Rather, to facilitate its credit cardholders with more convenience, it has a mobile app that allows you to manage your account efficiently and conveniently from your smartphone.

With this app, you can do the following things

- Checking Account Balance by tracking spending

- Checking Recent Transactions by viewing a detailed history of your recent transactions

- Making Payments and Setting Up Real-Time Alerts:

- Digital Wallet Function for Contactless Payments

And many more features to ensure the efficient management of your Mercury credit card account. You can make the most of the card’s benefits by equipping yourself with brief information about the Mercury mobile app here.

Some precautions regarding the Www.Mercury Pre-Approved Application

At this moment, I want to alert you regarding the potential drawbacks of this pre-approval. I acknowledge that applying with a reservation code could offer you several advantages, including saving time and effort, faster processing times, and a higher approval rate than traditional applications. Also, it can make exclusive offers and promotional rates accessible to the general public.

However, there still exist some potential drawbacks, including the lack of guarantee for final approval; some issues could happen with performing a hard credit check that can lead to a negative impact on your credit score. Also, there is no guarantee that every offer you are receiving is legitimate, so it also needs to be addressed because it could potentially lead to fraudulent activities.

Wrap Up

To wrap up the discussion, I would say that receiving a “Www.GoMercury.com Pre-Approved Application” can be an open-door opportunity for securing a new credit product with favorable terms. However, it is always advised to clear up your inquiries, take customer support, and go with the card as per your needs and preferences.

Always make a wise gap between receiving an offer and accepting it by searching properly about the lender to prevent yourself from any fraudulent activity.

In this guide, I tried my best to guide you properly about this game-changer in terms of pre-approved application, reservation code, customer support, mercury mobile app, and many more aspects.

It will help you streamline the application process by increasing your chances of approval and allowing you to gain access to a range of credit card payment options tailored to your needs.

Have proper financial freedom and prosperity!